DEBT MUTUAL FUNDS

vs

FIXED DEPOSITS

An Investor Education and Awareness Initiative

Fixed Deposits

• A Traditional Financial Instrument offered by Banks

• Fixed Deposits Provide Rate of Interest Higher than Regular Savings Account

• Offer Fixed Rate of Interest for a pre-specified Tenure

• Fixed Deposits come with a pre-defined Maturity Period

• Banks may Charge a Penalty for Premature Withdrawal

• Fixed Deposits are considered to be Safe Investments

• Banks also offer Recurring Deposits and Flexi Fixed Deposits

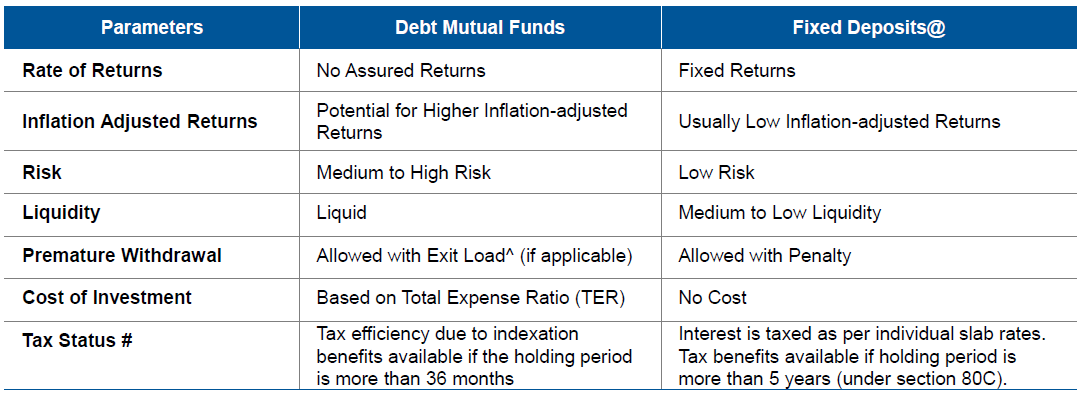

Debt Mutual Funds vs. Fixed Deposits

Points to Remember…

- Fixed Deposits are traditional investment instruments that provide a higher and assured Rate of Interest than a Regular Savings Account

- Fixed Deposits are covered by the Deposit Insurance and Credit Guarantee Corporation, which guarantees an amount of up to

Rs 1,00,000 per depositor per bank - The Rate of Interest on fixed deposits is fixed for a pre-specified Tenure

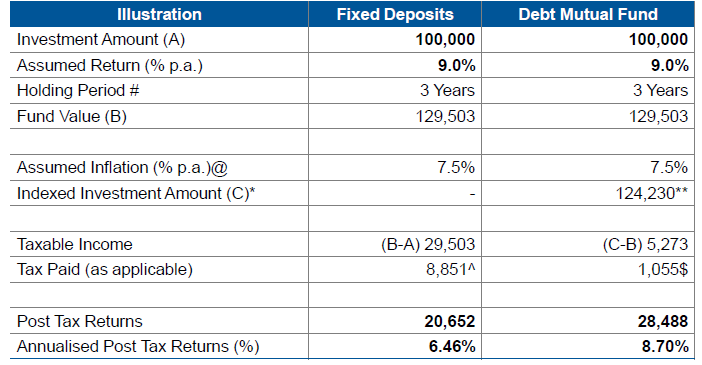

- Compared to bank fixed deposits, debt mutual funds have the potential to offer higher inflation-adjusted returns

- Fixed deposits are suitable for investors with low risk appetite

- Various types of Mutual funds are available for investors across risk appetite but there is no assurance on returns like fixed deposits

- Premature Withdrawal of fixed deposit may be allowed with a penalty

- Early redemption from mutual funds may be subject to exit load if applicable

- Debt Mutual Funds offer tax efficiencies if the holding period is more than 36 months as per current tax laws.

- Consider your risk appetite, investment time horizon and your return expectation while choosing between fixed deposits and / or debt mutual funds

Free Updates

We are regularly providing free updates related to mutual funds like Daily NAV’s of the fund, Fact sheets, Latest Portfolio Returns, Industry News, etc.

Easy to Use Platform

We are providing very easy to use, safe & secure, And friendly platform for mutual fund. That can provide all data on your finger tips.

Speak With us

For any question related to mutual fund speak with our experts. Our experts call back you as soon as possible.

Statement Of Account

For getting your statement of accounts of your investment log in to your portfolio now in our Safe and Secure Platform.

One minute of your time can help us serve you better!

Would be great if you could help with this super short survey